Part 2 of a 12-part operator series on the CMS ACCESS Model

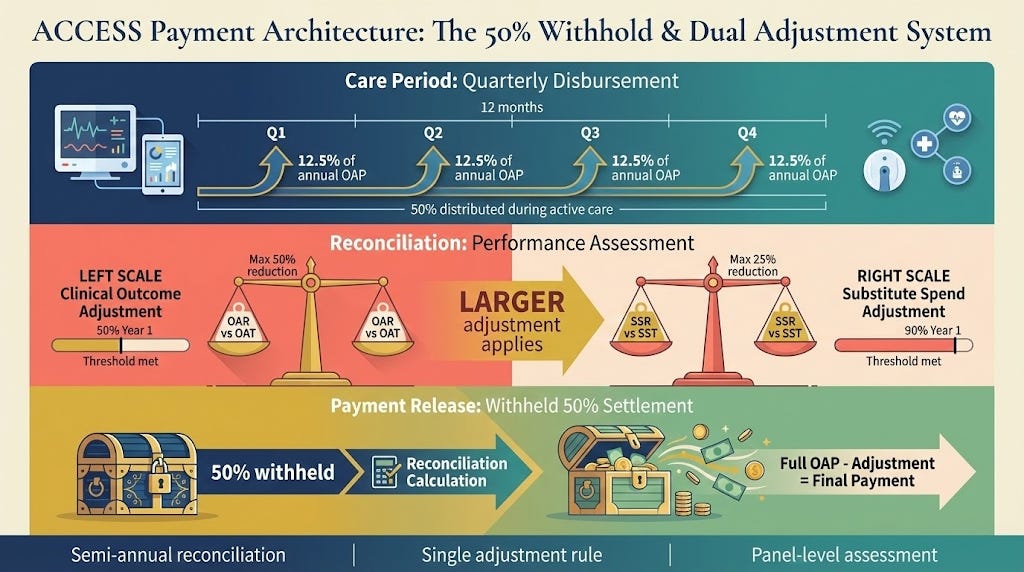

Today, we’re covering how ACCESS fundamentally restructures Medicare payment for chronic disease management. This is truly a different financial architecture than fee for service. Here’s how the mechanics work.

The 50% Withhold Structure

The payment model uses a split disbursement approach with backend reconciliation. During the 12-month care period, CMS distributes up to 50% of the total annual Outcome-Aligned Payment (OAP) through quarterly installments. You submit monthly claims using track-specific G-codes to your Medicare Administrative Contractor (MAC), which processes them as “zero-paid.” The Innovation Payment Contractor (IPC) then issues actual payments quarterly based on validated claims.

The remaining 50% sits in escrow until the care period concludes. This isn’t arbitrary—it creates the financial mechanism for outcome accountability while providing operational cash flow during active care delivery.

Clinical Outcome Adjustment: The Performance Threshold

At reconciliation, CMS calculates your Outcome Attainment Rate (OAR)—the percentage of completed 12-month care periods where patients met all required outcome measure targets for that track. This gets compared against the Outcome Attainment Threshold (OAT).

In Year 1, the OAT is 50%. If your OAR equals or exceeds 50%, you receive full payment with no adjustment. If your OAR falls below 50%, you receive proportional payment calculated as (OAR ÷ OAT) × full OAP amount.

Example: If 40% of your completed care periods met all outcome targets:

OAR = 40%

Calculation: 40 ÷ 50 = 0.80

You earn 80% of full OAP

Clinical Outcome Adjustment = 20% reduction

The adjustment caps at 50% reduction. If only 20% of patients met outcomes (which would yield 40% payment under the formula), you still receive 50% of the gross OAP. However, consistently performing below minimum thresholds subjects you to termination under the Participation Agreement.

The OAT will increase in subsequent participation years beyond 50%, creating a ramp that balances initial accessibility with long-term accountability. CMS will publish the year-by-year OAT schedule in 2026 before the first application deadline.

Substitute Spend Adjustment: Preventing Duplicative Care

The second adjustment mechanism addresses care coordination and duplicate spending. CMS calculates your Substitute Spend Rate (SSR)—the percentage of aligned patients who did not receive specified substitute services from other Medicare providers for the same qualifying condition during their ACCESS care period.

Each track includes a defined Substitute Spend List identifying services that represent new care initiation for the same diagnosis. For eCKM/CKM, this includes ambulatory blood pressure monitoring setup (CPT 93784, 93786, 93788, 93790), remote physiologic monitoring device setup (99453, 99473), diabetes self-management training (G0108), intensive behavioral therapy for cardiovascular disease (G0446) or obesity (G0447), medical nutrition therapy initial visits (97802), and MDPP enrollment (G9880, G9881, G9886, G9887).

For MSK: physical therapy evaluations (97161-97163), occupational therapy evaluations (97165-97167), and remote therapeutic monitoring setup (98975). For BH: digital health medical treatment device supply (G0552-G0553), initial individual psychotherapy (90832-90834, 90836-90838), and RTM setup (98975).

The Substitute Spend Threshold (SST) in Year 1 is 90%. If your SSR equals or exceeds 90%, no adjustment. Below 90%, proportional payment as (SSR ÷ SST) × full OAP.

Example: If 85% of your patients avoided substitute services:

SSR = 85%

Calculation: 85 ÷ 90 ≈ 0.944

You earn 94.4% of full OAP

Substitute Spend Adjustment = 5.6% reduction

This adjustment caps at 25% reduction.

The Single Adjustment Rule

Critical detail: CMS applies only the larger of the two adjustments during semi-annual reconciliation. If you face a 20% Clinical Outcome Adjustment and a 5% Substitute Spend Adjustment, you lose 20% total—not 25%. This prevents compounding penalties while maintaining accountability across both dimensions.

The reconciliation occurs twice per year, assessing all patients whose 12-month care periods ended during the trailing 6-month window. CMS nets the reduction against your withheld payments. Any remaining balance owed to you gets released through the next quarterly payment. If additional recovery is needed beyond withheld amounts, CMS may offset against future payments or initiate standard Medicare overpayment recovery procedures.

Payment Rates and Rural Adjustments

CMS hasn’t published specific dollar amounts yet—those come in 2026 before the April application deadline. What we know: payment rates vary by track, with higher rates for Initial Periods (first 12 months or when baseline measures aren’t at target) and lower rates for Follow-On Periods (maintenance care for established patients or those starting at target).

For eCKM and CKM tracks specifically, the payment includes expected device cost for a cellular network-connected blood pressure cuff used for condition management and outcome reporting. Rural patients in these tracks receive a fixed add-on payment to account for higher distribution costs. Other tracks don’t include device costs and therefore have no rural adjustment.

Rates may update annually based on Medicare Physician Fee Schedule (PFS) updates, regulatory changes, or an efficiency adjustment tied to the Medicare Economic Index (MEI) productivity adjustment percentage.

Multi-Track Discount

When a beneficiary enrolls in multiple tracks with the same participant, CMS applies a payment discount to the total OAP amount. This reflects administrative and operational efficiencies from delivering integrated care—shared intake, unified patient records, coordinated communication with PCPs. The specific discount percentage will be published with payment rates in 2026.

Cost-Sharing Policy

Participants must establish a uniform cost-sharing policy per track: either collect standard Medicare Part B cost-sharing or forego collection under the CMS-sponsored model patient incentive safe harbor (42 CFR § 1001.952(ii)(2)). This policy must apply consistently to all aligned beneficiaries within each track and can only be revised with CMS approval on a go-forward basis.

If you elect to collect cost-sharing, you must clearly disclose expected beneficiary payment amounts before enrollment. Most participants are expected to waive cost-sharing as a beneficiary engagement strategy, but the choice remains at the organizational level.

What the Payment Enables

This structure creates financial predictability—recurring revenue based on panel size—while tying full payment to measurable outcomes. The quarterly disbursement provides operational cash flow. The split threshold approach (50% for outcomes, 90% for substitute spend) balances accessibility for new participants against long-term accountability for results and coordinated care.

Unlike shared savings models where attribution complexity makes condition-specific savings hard to isolate, ACCESS directly measures clinical outcomes and duplicative spending. Unlike fee-for-service where reimbursement requires specific billing codes, ACCESS gives flexibility in care delivery modalities as long as outcomes are achieved.

The model explicitly accommodates technology-enabled care—virtual visits, remote monitoring, asynchronous engagement, FDA-cleared digital therapeutics—under appropriate clinical oversight. Payment doesn’t depend on time-based billing or in-person visit requirements. It depends on moving the clinical measures.

Next module, we’ll cover the six-stage beneficiary journey from discovery through reconciliation.